Schedule 14A Information

Proxy Statement Pursuant to Section 14(A) of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[X]x] Preliminary Proxy Statement [ ] Confidential, for Use of the Commission

[ ] Definitive Proxy Statement Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Additional Materials

[ ] Soliciting Material under Section 240.14a-12

FRANKLIN TEMPLETON VARIABLE INSURANCE PRODUCTS TRUST

Name of Person(s) Filing Proxy Statement, other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Franklin Founding Funds AllocationTEMPLETON DEVELOPING MARKETS VIP FUNDFund

(a series of Franklin Templeton Variable Insurance Products Trust)

IMPORTANT SHAREHOLDER INFORMATION

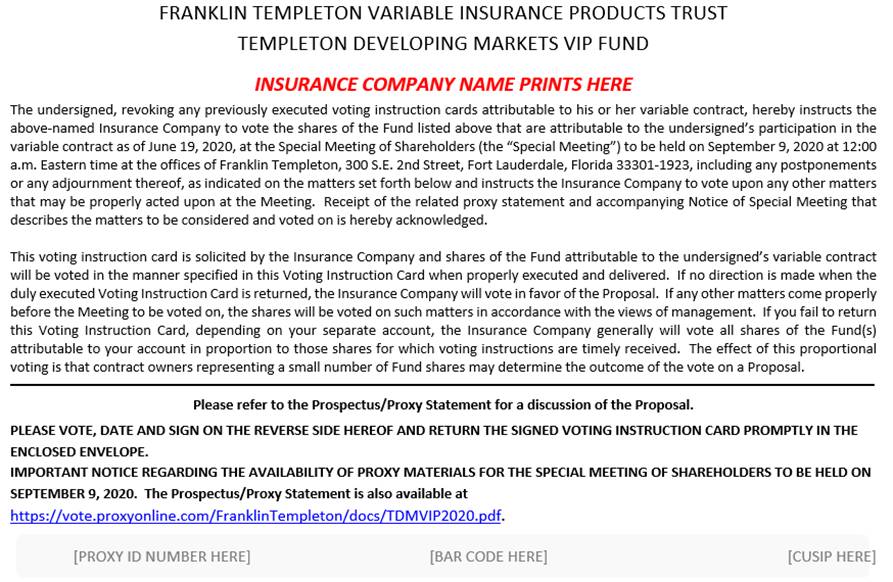

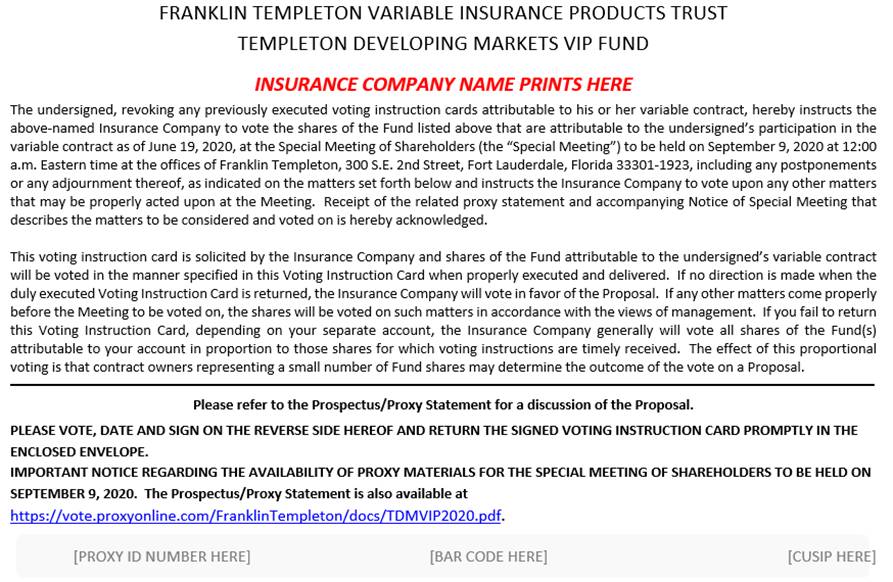

These materials are for a Special Meeting of Shareholders of the Franklin Founding Funds AllocationTempleton Developing Markets VIP Fund (the “Fund”), a series of Franklin Templeton Variable Insurance Products Trust (the “Trust”), scheduled for January 17, 2019,September 9, 2020, at 10:12:00 a.m.p.m., PacificEastern time, at the offices of Franklin Templeton, Investments, One Franklin Parkway, San Mateo, California 94403-1906.300 S.E. 2nd Street, Fort Lauderdale, Florida 33301-1923. The enclosed materials discuss several proposalsan important proposal (the “Proposals” or, each, a “Proposal”) to be voted on at the meeting and contain the Notice of Special Meeting of Shareholders, proxy statement and proxy card(s)card and/or voting instruction form(s).form. The shares of the Fund are sold to (i) separate accounts of certain life insurance companies (the “Participating Insurance Companies”) to fund benefits payable under certain variable annuity contracts and variable life insurance policies (“Variable Contracts”) issued by the Participating Insurance Companies; and (ii) certain qualified plans. The Participating Insurance Companies hereby solicit and agree to vote at the meeting, to the extent required, the shares of the Fund that are held in separate accounts in accordance with timely instructions received from owners of the Variable Contracts. With respect to all other shareholders, the Board of Trustees of the Trust is soliciting your vote.

If you are a Variable Contract owner, a voting instruction form is enclosed. When you vote your voting instruction form, it tells the Participating Insurance Company how you wish to vote the Fund shares attributable to your Variable Contract on important issues relating to the Fund underlying your Variable Contract. If you are a shareholder, one or morea proxy cards arecard is enclosed. The enclosed materials contain information about the ProposalsProposal being presented for your consideration. We request your prompt attention and vote by mail using the enclosed voting instruction form(s)form or proxy card(s).card.

We urge you to spend a few minutes reviewing the ProposalsProposal in the proxy statement. Then, please fill out and sign the voting instruction form(s)/form/proxy card(s)card and return it (them) in the postage-paid envelope. When Variable Contracts owners return their voting instructions promptly, the Fund may be able to save money by not having to conduct additional solicitations, including having the Participating Insurance Companies forward additional mailings. PLEASE COMPLETE, SIGN AND RETURN each proxy card/voting instruction form you receive.

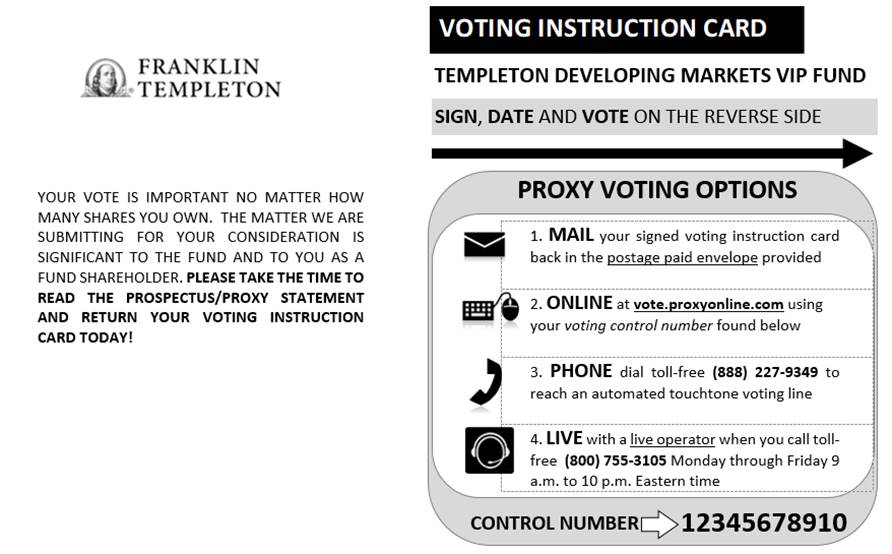

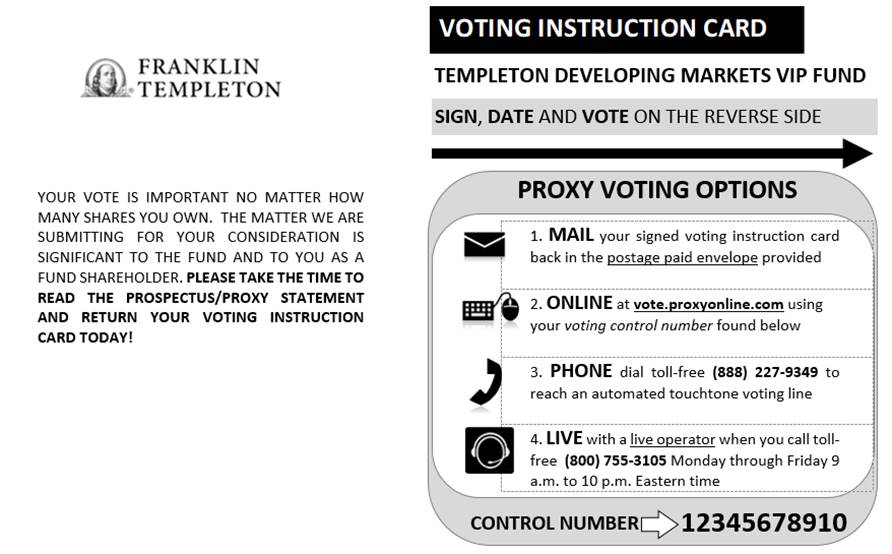

We welcome your comments. If you have any questions or would like to quickly vote your shares, call [_________________],AST Fund Solutions, LLC, our proxy solicitor, toll free at [_________________].(800) 755-3105. Agents are available 9:00 a.m. – 10:00 p.m., Eastern time, Monday through Friday, and 10:00 a.m. – 4:00 p.m., Eastern time, Saturday.Friday.

TELEPHONE AND INTERNET VOTING

For your convenience, you may be able to vote by telephone or through the Internet, 24 hours a day.

Separate instructions are listed on the enclosed voting instruction form(s)form or proxy card(s).card.

Franklin Founding Funds AllocationTEMPLETON DEVELOPING MARKETS VIP FUNDFund

(a series of Franklin Templeton Variable Insurance Products Trust)

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

The Board of Trustees of Franklin Templeton Variable Insurance Products Trust, on behalf of the Franklin Founding Funds AllocationTempleton Developing Markets VIP Fund (the “Fund”), has called a Special Meeting of Shareholders (the “Meeting”) of the Fund, which will be held at the offices of Franklin Templeton, Investments, One Franklin Parkway, San Mateo, California 94403-1906300 S.E. 2nd Street, Fort Lauderdale, Florida 33301-1923, on January 17, 2019,September 9, 2020, at 10:12:00 a.m.p.m., PacificEastern time.

During the Meeting, shareholders of the Fund will be asked to vote on the following Proposals:proposal:

1. Toapprove a new Investment Management Agreement with Franklin Advisers, Inc.

2. To approve new Subadvisory Agreements as follows (includes three (3) Sub-Proposals):

a.To approve a new Subadvisory Agreement with Templeton Global Advisors Limited for the management of a foreign strategy sleeve of the Fund.

b.To approve a new Subadvisory Agreement with Franklin Templeton Institutional, LLC (“FT Institutional”) for the management of an international growth strategy sleeve of the Fund.

c.To approve a new Subadvisory Agreement with FT Institutional for the management of an investment grade corporate strategy sleeve of the Fund.

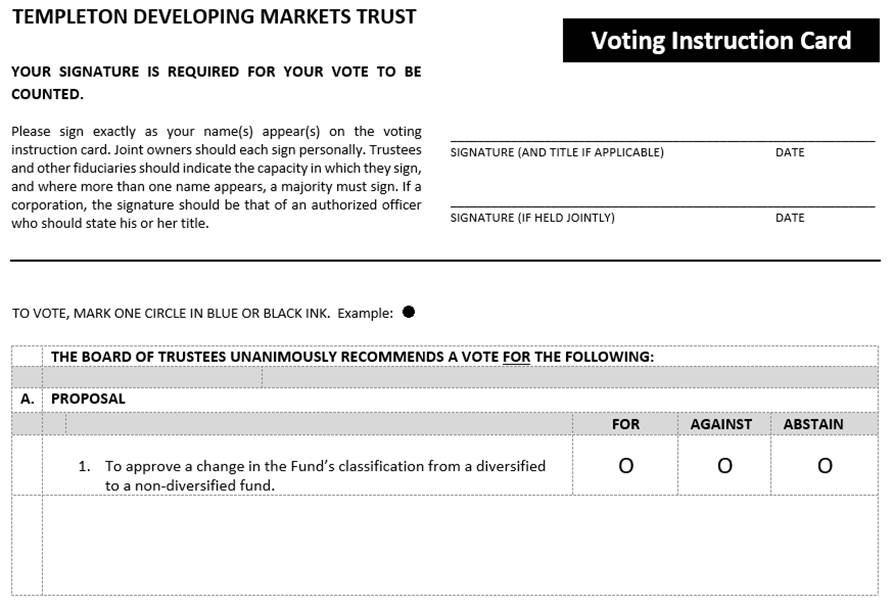

3. To approve the use of a “manager of managers” structure wherebychange in the Fund’s investment manager would be ableclassification from a diversified to hire and replace subadvisers without shareholder approval.a non-diversified fund.

The shares of the Fund are sold to (i) separate accounts of certain insurance companies (the “Participating Insurance Companies”) to fund benefits payable under certain variable annuity contracts and variable life insurance policies (“Variable Contracts”)issued by the Participating Insurance Companies; and (ii) certain qualified plans. The Participating Insurance Companies, as the shareholders of record of the Fund, hereby solicit and agree to vote at the Meeting, to the extent required, the shares of the Fund that are held in separate accounts in accordance with timely instructions received from owners of the Variable Contracts.

By Order of the Board of Trustees,

Craig S. TyleLori A. Weber

Co-Secretary and Vice President

[December , 2018]July 20, 2020

Please sign and promptly return all of the voting instruction form(s)form in the enclosed self-addressed envelope regardless of the number of shares attributable to your Variable Contract.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL SHAREHOLDER MEETING TO BE HELD ON SEPETEMBER 9January 17, 2019, 2020

The Notice of Special Meeting of Shareholders, proxy statement and form of proxy card are available on the Internet at [http:https://www.proxyonline.com/vote.proxyonline.com/FranklinTempleton/docs/FTproxy].TDMVIP2020.pdf. The form of proxy card on the Internet site cannot be used to cast your vote.

If you have any questions or wish to obtain directions to be able to attend the Meeting and vote in person, please call [_________________],AST Fund Solutions, LLC, our proxy solicitor, toll free at [_________________].(800) 755-3105.

Franklin Founding Funds Allocation VIP FUND

(a series of Franklin Templeton Variable Insurance Products Trust)

A Special Meeting of Shareholders of the Franklin Founding Funds Allocation VIPTEMPLETON DEVELOPING MARKETS vip Fund (the “Fund”), a series of Franklin Templeton Variable Insurance Products Trust (the “Trust”), will be held on January 17, 2019, to vote on several important proposals that affect the Fund. Please read the enclosed materials and cast your vote on the proxy cards(s) or voting instruction form(s).

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to call you to solicit your vote.

The proposals for the Fund have been carefully reviewed by the Trust’s Board of Trustees (the “Board”). The Trustees of the Trust, most of whom are not affiliated with Franklin Templeton Investments, are responsible for looking after your interests as a shareholder of the Fund. The Board believes these proposals are in the best interests of shareholders. The Board unanimously recommends that you vote FOR each proposal and sub-proposal.

Voting is quick and easy. Everything you need is enclosed. To cast your vote, simply complete the proxy card(s) or voting instruction form(s) enclosed in this package. Be sure to complete, sign and return the card/form before mailing it in the postage-paid envelope.

We welcome your comments. If you have any questions or would like to quickly vote your shares, please call [_________________], our proxy solicitor, toll-free at [_________________]. Agents are available 9:00 a.m. – 10:00 p.m., Eastern time, Monday through Friday, and 10:00 a.m. – 4:00 p.m., Eastern time, Saturday. Thank you for your participation in this important initiative.

The following Q&A is provided to assist you in understanding the proposals. The proposals are described in greater detail in the proxy statement. We appreciate your trust in Franklin Templeton Investments and look forward to continuing to help you achieve your financial goals.

Important information to help you understand and vote on the proposals

Below is a brief overview of the proposals to be voted upon. Your vote is important, no matter how large or small your holdings may be.

What proposals am I being asked to vote on?

Shareholders are being asked to vote on the following Proposals:

1. To approve a new Investment Management Agreement with Franklin Advisers, Inc. (“FAV”).

2. To approve new Subadvisory Agreements as follows(includes three (3) Sub-Proposals):

a.To approve a new Subadvisory Agreement with Templeton Global Advisors Limited (“Global Advisors”) for the management of a foreign strategy sleeve of the Fund.

b.To approve a new Subadvisory Agreement with Franklin Templeton Institutional, LLC (“FT Institutional”) for the management of an international growth strategy sleeve of the Fund.

c.To approve a new Subadvisory Agreement with FT Institutional for the management of an investment grade corporate strategy sleeve of the Fund.

3. To approve the use of a “manager of managers” structure whereby the Fund’s investment manager would be able to hire and replace subadvisers without shareholder approval.

Has the Board approved the proposals?

The Board has unanimously approved each proposal and sub-proposal and recommends that you vote to approve each proposal and sub-proposal.

1. To approve a new Investment Management Agreement with FAV.

Why is a new investment management agreement being recommended?

A new investment management agreement between FAV and the Trust, on behalf of the Fund (the “New IM Agreement”), is being proposed to reflect engagement of and the payment to FAV for investment management services that FAV is expected to provide to the Fund if the New IM Agreement is approved by shareholders. Franklin Templeton Distributors, Inc. (“Management”) proposed, and the Board approved, a repositioning of the Fund to transition from a fund of funds with a static allocation to three actively managed underlying funds, to a direct investment fund with an actively managed dynamic allocation strategy (the “Repositioning”). If approved, FAV would serve as investment manager of the Fund and manage certain investment strategies for the Fund (“sleeves”) alongside other Franklin Templeton Investments subadvisers (“FT Subadvisers”) in a “manager of managers” structure.

Because the Fund currently maintains a static allocation to three actively managed underlying funds, the Fund does not have its own investment manager, nor does it pay investment management fees. In connection with the Repositioning, shareholders are being asked to approve the New IM Agreement between the Fund and FAV, as well as three Subadvisory Agreements between FAV and other FT Subadvisers for the management of several investment strategy sleeves of the Fund, which are proposed in Sub-Proposals 2(a)-2(c). The New IM Agreement describes the services to be provided by FAV to the Fund, which include investment advisory services as well as administrative services, and thecompensation to be paid by the Fund in return for such services. The form of the Amended IM Agreement is included inExhibit A.

The Fund would pay FAV an overall investment management fee of 0.55% for its management of the Fund. The Fund would not pay any additional investment management fees to FAV for investment strategy sleeves managed by it or for any subadvisory services provided by the FT Subadvisers. The FT Subadviser would be compensated from the investment management fee paid by the Fund to FAV.

If the New IM Agreement is not approved by shareholders, the Fund will not be repositioned.

What effect will the approval of the New IM Agreement with FAV have on the Fund’s management fees and other expenses?

As noted above, because the Fund currently maintains a static allocation to underlying funds, the Fund does not have an investment manager, nor does it pay investment management fees. Franklin Templeton Services, LLC (“FT Services”) currently provides certain administrative services and facilities for the Fund including monitoring the percentage of the Fund’s assets allocated to the underlying funds and periodically rebalancing the Fund’s portfolio under a Fund Administration Agreement between the Fund and FT Services (the “Administration Agreement”). Pursuant to the Administration Agreement, the Fund pays FT Services a monthly fee equal to an annual rate of 0.10% of the average daily net assets of the Fund during the preceding month.

If the New IM Agreement is approved, the Fund would pay FAV an overall investment management fee of 0.55% for the management of the Fund, which would include investment advisory services as well as administrative services. The Administration Agreement with FT Services would then be terminated and FAV would enter into a sub-administration agreement with FT Services to provide certain administrative services and facilities for the Fund under which FAV would pay FT Services the standard funds’ fee schedule for administrative services. Accordingly, while the investment management fees would increase due to the new investment advisory services provided directly to the Fund, the total gross and net annual Fund operating expenses of the Fund are expected to decrease, primarily as a result of the decrease in the underlying fund fees and expenses.

2. To approve new Subadvisory Agreements with Global Advisors and FT Institutional.

Why are new subadvisory agreements with Global Advisors and FT Institutional being recommended?

As noted above, Management proposed, and the Board approved, the Repositioning. If approved by shareholders, FAV,a wholly-owned subsidiary of Franklin Resources, Inc. (“Franklin Resources”), would serve as investment manager of the Fund and manage investment strategy sleeves of the Fund alongside various FT Subadvisers in a “manager of managers” structure. A new subadvisory agreement with Global Advisors, and two new subadvisory agreements with FT Institutional, which are also both wholly-owned subsidiaries of Franklin Resources, are being proposed in order to allow Global Advisors and FT Institutionalto manage three investment strategy sleeves of the Fund.

What effect, if any, will the approval of the proposed new subadvisory agreements with Global Advisors and FT Institutional have on the Fund’s management fees?

The approval of the proposed new subadvisory agreements with Global Advisorsand FT Institutionalfor the Fund will have no impact on the amount of management fees paid by the Fund or the Fund’s shareholders (beyond those paid to FAV as discussed in Proposal 1) because Global Advisors’ and FTInstitutional’sfees will be deducted from the fees FAV, the Fund’s proposed investment manager, would receive from the Fund.

3. To approve the use of a “manager of managers” structure whereby the Fund’s investment manager would be able to hire and replace subadvisers without shareholder approval.

What is the purpose of the Manager of Managers Structure?

Shareholders of the Fund are being asked to approve the use of a “manager of managers” structure that would permit the Fund’s investment manager, subject to Board approval, to appoint and replace subadvisers that are affiliated with Franklin Templeton Investments (“FTI”), and subadvisers that are not affiliated with FTI, without obtaining prior shareholder approval (the “Manager of Managers Structure”). The Manager of Managers Structure would enable the Fund to operate with greater efficiency in the future by allowing the Fund to use both affiliated and unaffiliated subadvisers best suited to its needs without incurring the expense and potential delays that could be associated with obtaining shareholder approvals, particularly in light of the Repositioning of the Fund that would allow FAV to manage investment strategy sleeves of the Fund alongside various FT Subadvisers.

How will the Manager of Managers Structure affect the Fund?

The use of the Manager of Managers Structure will not change the fees paid to FAV by the Fund. In order for the Fund to rely on an exemptive order received by FAV from the U.S. Securities and Exchange Commission (the “SEC”) permitting the use of the Manager of Managers Structure, the Fund’s use of the Manager of Managers Structure must be approved by the affirmative vote of a “majority of the outstanding voting securities” of the Fund, as defined in and required by the Investment Company Act of 1940. The Board determined to seek shareholder approval of the Manager of Managers Structure in connection with this special shareholder meeting, which was called for purposes of voting on other matters described in the proxy statement, to avoid additional meeting and proxy solicitation costs in the future.

Who is [_________________]?

[_________________] (the “Solicitor”) is a company that has been engaged by the Trust, on behalf of the Fund, to assist in the solicitation of proxies. The Solicitor is not affiliated with the Fund or with FTI. In order to hold a shareholder meeting, a certain percentage of the Fund’s shares (often referred to as “quorum”) must be represented at the meeting. If a quorum is not attained, the meeting must adjourn to a future date. Insurance companies may retain the Solicitor themselves to solicit voting instructions from contract owners; that solicitation could include multiple mailings and phone calls to remind variable contract owners to cast their votes by returning their voting instruction forms so that the special shareholder meeting does not have to be adjourned or postponed.

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each share (and a proportionate fractional vote for each fractional share) attributable to your variable annuity or variable life insurance contract on the record date. The record date is November 1, 2018.

How do I vote my shares?

You can vote your shares by completing and signing the enclosed proxy card(s) or voting instruction form(s) and mailing it (them) in the enclosed postage-paid envelope. If eligible, you may also vote using atouch-tone telephone by calling the toll-free number printed on your proxy card(s) or voting instruction form(s) and following the recorded instructions, or through the Internet by visiting the web site printed on your proxy card(s) or voting instruction form(s) and following the on-line instructions. You can also vote your shares in person at the special meeting of shareholders. If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call the Solicitor toll-free at[_________________].

How do I sign the proxy card?

Individual Accounts: Shareholders should sign exactly as their names appear on the account registration shown on the proxy card(s) or voting instruction form(s).

Joint Accounts: Either owner may sign, but the name of the person signing should conform exactly to a name appearing on the account registration as shown on the proxy card(s) or voting instruction form(s).

All Other Accounts:The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, “Ann B. Collins, Trustee.”

Q&A

-iv-

Franklin Founding Funds Allocation VIP FUND

(a series of Franklin Templeton Variable Insurance Products Trust)

PROXY STATEMENT

¿ INFORMATION ABOUT VOTING

Who is asking for my vote?

The Board of Trustees of Franklin Templeton Variable Insurance Products Trust (the “Trust”), on behalf of the Franklin Founding Funds AllocationTempleton Developing Markets VIP Fund (the “Fund”), in connection with a Special Meeting of Shareholders of the Fund to be held on January 17, 2019September 9, 2020 (the “Meeting”), has requested your vote on several matters.an important proposal (the “Proposal”).Shares of the Fund are sold to (i) separate accounts of certain insurance companies (the “Participating Insurance Companies”) to fund benefits payable under certain variable annuity or variable life insurance contracts (“Variable Contracts”) issued by the Participating Insurance Company; and (ii) certain qualified plans. As an owner of a Variable Contract, you have the right to instruct the Participating Insurance Company how to vote shares of the Fund attributable to your Variable Contract. Therefore, each Participating Insurance Company hereby solicits voting instructions from the owners of the Variable Contracts issued by such Company with respect to the shares of the Fund attributable to such Variable Contracts.

For the limited purpose of this proxy statement, the terms “shareholder,” “you” and “your” refer to Variable Contract owners, as beneficial owners of Fund shares, and to the Participating Insurance Companies as direct owners of Fund shares, as well as any other direct shareholders of the Fund, unless the context otherwise requires.

Who is eligible to vote?

Shareholders of record at the close of business on November 1, 2018June 19, 2020 are entitled to be present and to vote at the Meeting or any adjourned Meeting. Each share of record of the Fund is entitled to one vote (and a proportionate fractional vote for each fractional share) on each matter presentedthe Proposal at the Meeting. The Notice of Special Meeting of Shareholders, the proxy cards,card, the voting instruction form(s)form and the proxy statement were first mailed to shareholders of record on or about [December, 2018].July 20, 2020.

On what issues am I being asked to vote?

Shareholders are being asked to vote on the following Proposals:

1. To approve a new Investment Management Agreement with Franklin Advisers, Inc. (“FAV” or the “Manager”).

2. To approve new Subadvisory Agreements as follows(these Proposals involve separate votes on Sub-Proposals 2(a), 2(b) and 2(c)):

a.To approve a new Subadvisory Agreement with Templeton Global Advisors Limited (“Global Advisors”) for the management of a foreign strategy sleeve of the Fund.

b.To approve a new Subadvisory Agreement with Franklin Templeton Institutional, LLC (“FT Institutional”) for the management of an international growth strategy sleeve of the Fund.

c.To approve a new Subadvisory Agreement with FT Institutional for the management of an investment grade corporate strategy sleeve of the Fund.

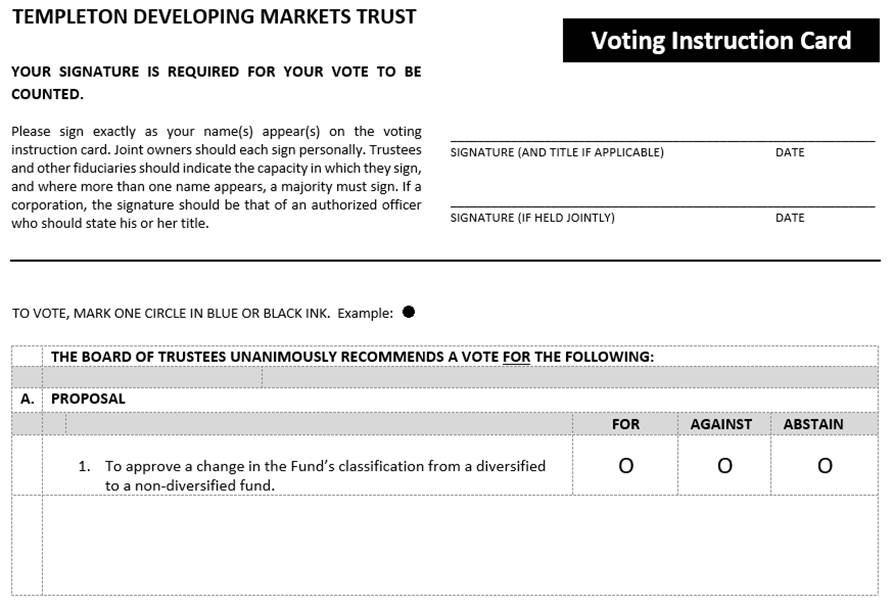

3. To approve the use of a “manager of managers” structure wherebyProposal to change the Fund’s investment manager would be ableclassification from a diversified fund to hire and replace subadvisers without shareholder approval.a non-diversified fund.

How does the Board of Trustees of the FundTrust recommend that I vote?

The Board of Trustees of the Trust (the “Board”), unanimously recommendrecommends that you vote:

1.vote FOR the approval of a new Investment Management Agreement with FAV.

2. FOR the approval of each new Subadvisory Agreement (these Proposals involve separate votes on Sub-Proposals 2(a), 2(b) and 2(c)).

3. FOR the approval of the use of a “manager of managers” structure wherebyproposal to change the Fund’s investment manager would be ablediversification classification from a diversified fund to hire and replace subadvisers without shareholder approval.a non-diversified fund.

How do I ensure that my vote is accurately recorded?

You may attend the Meeting and vote in person or you may complete and return the enclosed proxy card/voting instruction form.

For Variable Contract Owners: Voting instruction forms that are properly signed, dated and received by the applicable Participating Insurance Company will be voted as specified. If you specify a vote on any of the Proposals 1 through 3,Proposal, your Participating Insurance Company will vote those shares attributable to your Variable Contract as you indicate. Any shares of the Fund for which signed voting instructions forms are received but without specified instructions will be voted FOR the Proposal(s) or Sub-Proposal(s).Proposal. Any shares of the Fund for which no voting instructions are received generally will be voted by the Participating Insurance Company in proportion to those shares for which timely instructions are received. The effect of this proportional voting is that Variable Contract owners representing a small number of Fund shares may determine the outcome of the vote on a Proposal or Sub-Proposal.the Proposal. Variable Contract owners should contact their Participating Insurance Company for information about any applicable deadline for providing voting instructions to such Participating Insurance Company. Please see your Variable Contract prospectus for information on how to contact your Participating Insurance Company.

For Direct Owners (and not Variable Contract Owners): Proxy cards that are properly signed, dated and received at or prior to the Meeting will be voted as specified. If you specify a vote on all of the Proposals and Sub-Proposals,Proposal, your proxy will be voted as you indicate. If you specify a vote on one or more Proposal(s) or Sub-Proposal(s) but not all of the Proposal(s) and Sub-Proposal(s), your proxy will be voted as specified on such Proposal(s) and Sub-Proposals and, on the Proposal(s) and Sub-Proposal(s) for which no vote is specified, your proxy will be voted FOR all of the Proposals and Sub-Proposals. Ifyou simply sign, date and return the proxy card, but do not specify a vote on any of the Proposals and Sub-Proposals on which you are entitled to vote,Proposal, your proxy will be voted FOR all of the Proposals and Sub-Proposals on which you are entitled to vote.Proposal.

May I revoke my proxy?

If you are a Variable Contact owner, you may revoke your voting instructions by sending a written notice to the applicable Participating Insurance Company expressly revoking your instructions, by signing and forwarding to the Participating Insurance Company later-dated voting instructions, or otherwise giving notice of revocation at the Meeting. Variable Contract owners should contact their Participating Insurance Company for further information on how to revoke previously given voting instructions, including any applicable deadlines. Please see your Variable Contract prospectus for information on how to contact your Participating Insurance Company.

If you are a direct owner of Fund shares, you may revoke your proxy at any time before it is voted by forwarding a written revocation or a later-dated proxy card to the Fund that is received by the Fund at or prior to the Meeting, or by attending theMeeting and voting in person. Eligible shareholders who intend to attend the Meeting in person will need to bring proof of share ownership, such as a shareholder statement or letter from a custodian or broker-dealer confirming ownership, as of November 1, 2018,June 19, 2020, and a valid picture identification, such as a driver’s license or passport, for admission at the Meeting. Shareholders without proof of ownership and identification will not be admitted.

Who will pay proxy solicitation costs?

The costs of soliciting proxies, including the fees of a proxy soliciting agent, will be borne approximately 50% by the Fund, and 50% by FAV. However, in lightregardless of whether shareholders approve the current expense waivers that are in place for the Fund, FAV or an affiliate will ultimately pay the Fund’s portion of the expenses.Proposal. For more information, please see “FURTHER INFORMATION ABOUT VOTING AND THE MEETING – Solicitation of Proxies.”

¿ THE PROPOSALS

PROPOSAL 1: TO APPROVE A NEW INVESTMENT MANAGEMENT AGREEMENT WITH FRANKLIN ADVISERS, INC.

The Board unanimously recommends that the shareholders of the Fund approve a new Investment Management Agreement with FAV.

Background

The Fund is currently structure as a “fund of funds” meaning that it seeks to achieve its investment goals by investing its assets in a combination of the Franklin Income VIP Fund (33 1/3%), Franklin Mutual Shares VIP Fund (33 1/3%) and Templeton Growth VIP Fund (33 1/3%) (the “Underlying Funds”). The Fund makes equal allocations to each of the Underlying Funds on a fixed percentage basis. The administrator rebalances the Fund’s investments in the Underlying Funds periodically and may recommend to the Fund’s Board additional or different Underlying Funds for investment (without the approval of shareholders). These Underlying Funds, in turn, invest primarily in U.S. and foreign equity securities, and, to a lesser extent, fixed income and money market securities, each following a value oriented approach.

¿ AsPROPOSAL: TO CHANGE THE FUND’S classification from a shareholderdiversified to a non-diversified fund

Background

The Investment Company Act of 1940 (“1940 Act”) requires each investment company to classify itself as either a “diversified” or “non-diversified” fund and recite in its registration statement its classification. If a fund is “diversified,” it may not purchase the securities of any one issuer if, at the time of purchase, with respect to 75% of the Underlying Funds,fund’s total assets, more than 5% of its total assets would be invested in the Fund pays, indirectly through its investments, a proportionate sharesecurities of that issuer, or the fund would own or hold more than 10% of the expensesoutstanding voting securities of that issuer. Up to 25% of a fund’s total assets may be invested without regard to these limitations. These limitations do not apply to securities issued or guaranteed as to principal or interest by the U.S. government or any of its agencies or instrumentalities, or to the securities of other investment companies. A non-diversified fund is any fund that does not meet the diversification requirements of the 1940 Act.

The Fund is currently classified as a “diversified” fund and has the following fundamental investment restriction regarding diversification:

[The Fund may not:] Purchase the securities of any one issuer (other than the U.S. government or any of its agencies or instrumentalities or securities of other investment companies, whether registered or excluded from registration under Section 3(c) of the 1940 Act) if immediately after such Underlying Funds (hereafter referred to as “acquired fund expenses”). These acquired fund expenses make up a significant portioninvestment (a) more than 5% of the value of the Fund’s total expenses. Franklin Templeton Distributors, Inc. (“Management”) believes that the overall investment goalsassets would be invested in such issuer or (b) more than 10% of the Fund are viable and provide important investment options for shareholders, but that the Fund can potentially operate more efficiently and cost effectively.Management anticipates that the Repositioning from a static allocation fundoutstanding voting securities of funds to a direct investment allocation fundsuch issuer would eliminate a substantial portion of the acquired fund expenses currently paidbe owned by the Fund, and, as a result, reduceexcept that up to 25% of the value of the Fund’s total expenses. The repositioned Fund would continueassets may be invested without regard to provide broad asset allocation, but would do so using the latest active allocationsuch 5% and monitoring processes.10% limitations.

Management also believesThe Fund’s classification as a “diversified” fund and its current fundamental investment policy on diversification set forth above may not be changed or eliminated without shareholder approval. The Fund has been classified as a “diversified” fund since its inception. However, the asset class in which the Fund invests, the developing markets equity asset class, has experienced fundamental changes that the Repositioning will enablehave made it difficult for the Fund to be more widely distributed across insurance company platforms and, therefore, potentially reducepursue its existing investment strategy while maintaining its diversification status. Over the Fund’s overall expenses through economies of scale. In addition, Management believes that the transition from a fund of funds to direct investments would allow the Fund’s portfolio managers to provide a greater degree of diversification across asset classes and strategies, better tailor the Fund’s portfolio to achieve its investment goals and reduce the volatilitycourse of the Fund’s returns.

Currently, Franklin Templeton Services, LLC (“FT Services”) rebalanceslast ten years, the Fund’s investments in the Underlying Funds periodically for a monthly fee equal to an annual rate of 0.10% of the average daily net assets of the Fund pursuant to an administration agreement between FT Services and the Fund (the “Current Admin Agreement”). The Fund would need to enter into an investment management agreement to utilize the proposed direct investment allocation approach and directly purchase and sell securities and other investments (rather than indirectly through various Underlying Funds) and directly managedeveloping markets equity asset allocations. The proposed investment management agreement between FAV and the Fund (the “New IM Agreement”) describes the services that would be providedclass has become increasingly dominated by FAV to the Fund, which would include investment advisory services as well as administrative services, and the compensation to be paid by the Fund in return for such services. A copy of the form of the New IM Agreement, between the Trust and FAV is attached hereto asExhibit A. The investment management fee under the New IM Agreement would be 0.55% of the average daily net assets of the Fund, which would be a new fee for the Fund. This change also would include a change to the current expense limitation, as more fully described below. In addition, if shareholders approve the New IM Agreement, the Current Admin Agreement between the Fund and FT Services would be terminated.1

If the New IM Agreement is approved, Management anticipates that the Repositioning will decrease the overall fees and expenses of Fund. Management expects that the combination of the new investment management fee, including the modified expense limitation, and the reduction of acquired fund fees and expenses will cause the total gross and net annual Fund operating expenses of each class of the Fund (as reported in the Fund’s Annual Fund Operating Expenses in its Prospectus) to decrease by approximately 0.17% and 0.19%, respectively, during the first year after the Repositioning.

Management proposed the approval of the New IM Agreement to the Board in conjunction with the Repositioning, as more fully described below. The Board voted to approve the New IM Agreement and the Repositioning, and is recommending that shareholders approve the New IM Agreement.

1 FAV would enter into a sub-administration agreement with FT Services to provide certain administrative services and facilities for the Fund under which FAV would pay FT Services the standard funds’ fee schedule for administrative services

How will the Fund be managed after the Repositioning?

If the New IM Agreement is approved by shareholders, Management anticipates converting the Fund’s current fund of funds structure to a direct investment fund with an actively managed dynamic allocation strategy. The repositioned Fund would typically maintain overall target net asset weightings of 60% in equity investments and 40% in fixed income investments, with the ability to vary from each of these weightings by 5% under normal market conditions. The Fund also expects to maintain non-U.S. exposure generally in the range of 10% to 30% of its net assets, with a maximum emerging markets exposure target of 5%. Both the equity portion of the Fund and the fixed income portion could have non-U.S. exposure. FAV would serve as investment manager of the Fund, and FAV and various FT Subadvisers would manage investment strategy sleeves of the Fund in a “manager of managers” structure.

The Franklin Templeton Multi-Asset Solutions team of FAV would manage the Fund by employing a portfolio construction process and making tactical adjustments to it from time to time, including using derivatives for efficiency in executing these “overlay” adjustments at the Fund level. The primary purpose of the overlay adjustments would be to manage risk exposures, e.g., to reduce equity market exposure during times of extreme market volatility without impacting management of the underlying strategies. FAV would also make and adjust allocations among the sleeves, allocations between equity and fixed income, and between U.S. and non-U.S. investments. Overall, the repositioned Fund is expected to have a greater allocation to fixed income than the current Fund, as well as a higher allocation to U.S. investments. Management believes that the overall risk profile of the Fund would not change materiallylarge companies as a result of the Repositioning, and may decrease moderately under normal market conditions.

The strategy sleeves would include U.S. Smart Beta Equity, Franklin Total Return, Franklin Growth Strategy, Templeton Foreign,2 Franklin International Growth,3 Franklin U.S. Government Securities, Franklin Rising Dividends, Investment Grade Corporate4 and Templeton Global Bond. Unless indicated, the individual strategy sleeves would be managed by FAV. Allocationsnew companies being added to the individually managed sleeves are anticipated to range typically between 5% to 20%, but would vary with market conditions; however, no sleeve would constitutedeveloping markets investment universe, as well as the significant outperformance of some of these companies, which has resulted in a majorityhigher level of concentration of these companies in the Fund’s asset class. In other words, these companies now represent a large percentage of the Fund’s assets. Additional information regarding each sleeve is includedinvestment universe inExhibit B.

As noted above, Management believes the changes would: (1) continue to provide broad asset allocation, but would do so using the latest active allocation and monitoring processes; (2) enable which the Fund invests.

Due to be more widely distributed across insurance company platforms and reducethese structural changes to the Fund’s overall expenses; and (3) allowinvestment universe, the Fund is not able to take as large of positions in these companies that the Investment Manager believes is beneficial for the Fund’s portfolio managersbecause it is limited in doing so to maintain its diversified status. (For a diversified fund, all investments greater than 5% in any one issuer may not exceed, in the aggregate, 25% of the fund’s assets.) Thus, changing the Fund’s classification to non-diversified would provide the Fund with the flexibility to pursue its investment strategy given that the Investment Manager believes the high level of concentration in the Fund’s asset class will remain for the foreseeable future. As a non-diversified fund, the Fund could invest a greater degreeportion of diversification across asset classesits assets in any one issuer and strategies, better tailor the Fund’s portfolio to achieve its investment goals, and reduce the volatilitycould invest overall in a smaller number of the Fund’s returns. [If Proposal 1 is not approved by shareholders of the Fund, it is expected that the Fund will continue to operate under its Current Admin Agreement and the repositioning would not occur.] The Board would need to consider what steps to take with respect to the ongoing management of the Fund.

2 This strategy would be managed by Global Advisors pursuant toissuers than a subadvisory agreement between FAV and Global Advisors, subject to shareholder approval in Sub-Proposal 2(a).

3 This strategy would be managed by FT Institutional pursuant to a subadvisory agreement between FAV and FT Institutional, subject to shareholder approval in Sub-Proposal 2(b).

4 This strategy would be managed by FT Institutional pursuant to a subadvisory agreement between FAV and FT Institutional, subject to shareholder approval in Sub-Proposal 2(c).

If the New IM Agreement is approved by shareholders, how will the Fund’s expenses change?

In connection with the Repositioning, the Board is recommending that shareholders approve the New IM Agreement, which includes an investment management fee of 0.55% of the average daily net assets of the Fund. As of August 31, 2018, the net assets of the Fund were $923 million. Pursuant to the Current Admin Agreement, the Fund pays FT Services an administrative fee of 0.10% of the average daily net assets of the Fund. The aggregate amount of administrative fees paid by the Fund to FT Services for the fiscal year ended December 31, 2017 was $1,018,274. The New IM Agreement includes investment advisory services as well as administrative services, and, accordingly, if shareholders approve the New IM Agreement, the Current Admin Agreement between the Fund and FT Services would be terminated.

Had the Repositioning been in effect for the fiscal year ended December 31, 2017, the aggregate amount of investment management fees, excluding waivers, payable to FAV from the Fund would have been $[ ]; amounting to an increase to the management fees, after accounting for the termination of the Current Admin Agreement and the administrative fees being paid through the New IM Agreement, of [ ]% of the average net assets for the Fund. Although the management fees would have been higher if the Repositioning had been in effect, the Fund’s indirect expenses, in the form of acquired fund expenses, would have been reduced in an amount greater than the increased investment management fees, as illustrated in the table below.

The contractual fee waiver currently in place limits common expenses (i.e., a combination of administration fees and other expenses but excluding Rule 12b-1 fees, acquired fund expenses and certain non-routine expenses or costs, including those related to litigation, indemnification, reorganizations and liquidations) for each class of the Fund to 0.10%. The current fee waiver is due to expire April 30, 2019. Notably this current fee waiver does not apply to the acquired fund expenses, meaning the Fund must also bear indirectly the full cost of acquired fund expenses. In contrast, in connection with the Repositioning, FAV has contractually agreed to waive fees and reimburses expenses so that the total annual operating expenses of the Fund (not including Rule 12b-1 fees,but including acquired fund expenses) do not exceed 0.57%.

[The following tables compare the current fees and expenses (as of September 30, 2018) of the Fund as a percentage of daily net assets to the estimated expenses on a pro forma basis assuming completion of the Repositioning:]

| Class 1 | Class 2 | Class 4 |

| Current | Pro Forma | Current | Pro Forma | Current | Pro Forma |

Management fees | None | 0.55% | None | 0.55% | None | 0.55% |

Distribution and service (12b-1) fees | None | None | 0.25% | 0.25% | 0.35% | 0.35% |

Other expenses | 0.12% | 0.03% | 0.12% | 0.03% | 0.12% | 0.03% |

Acquired fund fees and expenses | 0.66% | 0.03% | 0.66% | 0.03% | 0.66% | 0.03% |

Total annual Fund operating expenses | 0.78% | 0.61% | 1.03% | 0.86% | 1.13% | 0.96% |

Fee waiver and/or expense reimbursement* | -0.02% | -0.04% | -0.02% | -0.04% | -0.02% | -0.04% |

Total annual Fund operating expenses after fee waiver and/or expense reimbursement | 0.76% | 0.57% | 1.01% | 0.82% | 1.11% | 0.92% |

* Currently, FT Services has contractually agreed to waive or assume certain expenses so that common expenses (excluding Rule 12b‑1 fees, acquired fund fees and expenses and certain non-routine expenses) do not exceed 0.10% until April 30, 2019. If the New IM Agreement is approved, Management will waive fees and reimburses expenses so that the total annual operating expenses of the Fund (not including Rule 12b-1 fees, but including acquired fund fees and expenses) do not exceed 0.57%.

diversified fund.

The following ExamplesTherefore, shareholders are intendedbeing asked to help you compareapprove the cost of investing in the Fund currently and on a pro forma basis, assuming completion of the Repositioning, as of September 30, 2018. The Examples assume that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of the period. The Examples also assume that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The Examples reflect adjustments madeProposal to change the Fund’s operating expenses dueclassification from “diversified” to the fee waivers and/or expense reimbursements by management for the 1 Year numbers only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:“non-diversified,” which includes eliminating its current fundamental investment restriction regarding diversification.

Class 1 | 1 Year | 3 Years | 5 Years | 10 Years |

Current | $80 | $249 | $433 | $966 |

Pro Forma | $[ ] | $[ ] | $[ ] | $[ ] |

Class 2 | 1 Year | 3 Years | 5 Years | 10 Years |

Current | $105 | $328 | $569 | $1,259 |

Pro Forma | $[ ] | $[ ] | $[ ] | $[ ] |

Class 4 | 1 Year | 3 Years | 5 Years | 10 Years |

Current | $115 | $359 | $622 | $1,375 |

Pro Forma | $[ ] | $[ ] | $[ ] | $[ ] |

How will the Repositioning be effected?

If the New IM Agreement is approved by the Fund’s shareholders, FAV anticipates that, to effect the Repositioning, the Fund will redeem its investments in each of the Underlying Funds in cash. The Fund will bear any transaction costs realized in connection with the reinvestment of the redemption proceeds received from the Underlying Funds. Management considered the potential tax consequences to the Underlying Funds that could result from the Fund redeeming its investments in cash. Such tax consequences arise because of embedded unrealized capital gains in the portfolio holdings of the Underlying Funds that will be realized when such holdings are sold. Insurance companies offer variable annuity and variable life insurance products (“Contracts”) to investors through separate accounts. When shares of the Fund or Underlying Funds are investment options of Contracts, separate accounts and not the owners of the Contracts, are generally the shareholders of the Fund or Underlying Funds. As a result, it is anticipated that any income dividends or capital gains distributions paid by the Fund or an Underlying Fund as a result of the Repositioning or ordinary portfolio turnover will be exempt from current taxation to the purchaser of such Contracts if left to accumulate within a Contract. Therefore, Management believes that neither the shareholders of the Fund nor the shareholders of the Underlying Funds will be materially impacted by the capital gains realized as a result of the Repositioning of the Fund.

Additional information about the Manager and FT Services

FAV, located at One Franklin Parkway, San Mateo, California 94403-1906, is organized as a California corporation and is registered as an investment adviser with the U.S. Securities and Exchange Commission (the “SEC”). As of [_____] [___], FAV managed approximately $[____] billion in assets. FAV is wholly-owned by Franklin Resources, which is a publicly held corporation. The name, address and principal occupation of the principal executive officers and directors of FAV are as follows:

Name

| Address

| Principal Occupation

|

Rupert H. Johnson, Jr.

Director

| One Franklin Parkway

San Mateo, CA 94403-1906

| Director of FAV; Vice Chairman and Director,Franklin Resources; and officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources and of investment companies in Franklin Templeton Investments.

|

Edward B. Jamieson

President, Chief Investment Officer And Director

| One Franklin Parkway

San Mateo, CA 94403-1906

| President, Chief Investment Officer and Director, FAV; and officer and/or trustee, as the case may be, of some of the other subsidiaries ofFranklin Resources and of investment companies in Franklin Templeton Investments.

|

Christopher J. Molumphy

Director and Executive Vice President

| One Franklin Parkway

San Mateo, CA 94403-1906

| Director and Executive Vice President, FAV; and officer of some of the other subsidiaries ofFranklin Resources and of investment companies in Franklin Templeton Investments.

|

Kenneth A. Lewis

Chief Financial Officer

| One Franklin Parkway

San Mateo, CA 94403-1906

| Chief Financial Officer, FAV; Executive Vice President and Chief Financial Officer of Franklin Resources; and officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources

|

John M. Lusk

Director And Vice President

| One Franklin Parkway

San Mateo, CA 94403-1906

| Director and Vice President, FAV; and officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources

|

FT Services, with its principal address at One Franklin Parkway, San Mateo, California 94403-1906, is an indirect, wholly-owned subsidiary of Franklin Resources and an affiliate of FAV. FT Services serves as the Fund’s administrator pursuant to the Current Admin Agreement dated April 17, 2012. The Trust’s Board most recently voted to renew the Current Admin Agreement on April 17, 2018.

Are there any material differences between the New IM Agreement and the Current Admin Agreement?

The New IM Agreement and Current Admin Agreement for the Fund are substantially similar with respect to the provision of administrative services, except for non-material revisions to conform the descriptions of such services with the latest forms of investment management agreements used across the FTI fund complex and the removal of provisions regarding monitoring and rebalancing the Fund’s allocation to Underlying Funds in light of the Repositioning. The remaining material differences relate to the provision of investment advisory services that would be provided to the Fund as a result of the transition from a fund of funds to a direct investment structure. These provisions are common in the latest forms of investment management agreements used across the FTI fund complex and are described in more detail below, including a provision to reflect the ability of the Fund to operate in a “manager of managers” structure, which is subject to shareholder approval and discussed in Proposal 3. If the New IM Agreement is approved by shareholders but the manager of managers structure discussed in Proposal 3 is not, the provisions of the New IM Agreement would generally require the approval of the Fund’s shareholders for the investment manager to enter into new or amended subadvisory agreements.

What are the material terms of the New IM Agreement?

Below is a summary of the material terms of the New IM Agreement. The following discussion is qualified in its entirety by reference to the form of the IM Agreement attached asExhibit Ato this proxy statement.

Services. The investment management services for which FAV is responsible for providing to the Fund in the New IM Agreement are new. FAV would be responsible for managingeffect will changing the Fund’s assets subjectstatus from “diversified” to and in accordance with“non-diversified” have on the Fund’s investment goals and policies, the terms of the Agreement, and any directions which the Board may issue from time to time. In addition, FAV would make all determinations with respect to the investment of the Fund’s assets and the purchase and sale of the Fund’s investment securities, and will take such steps as may be necessary to implement the same. Further, FAV, its officers and employees would be responsible under the IM Agreement to make available and provide accounting and statistical information required by the Fund in the preparation of registration statements,reports and other documents required by federal and state securities laws and with such information as the Fund may reasonably request for use in the preparation of such documents or of other materials necessary or helpful for the underwriting and distribution of the Fund’s shares.

FAV also will be responsible during the term of the New IM Agreement, as it is under the Current Admin Agreement, to provide or procure, as applicable, at its own expense (unless otherwise agreed to by the parties), the following administrative services to the Fund to the extent that any such services are not otherwise provided by any subadviser or other service provider to the Fund: (a) providing office space, equipment and supplies appropriate for the effective administration of the Fund; (b) providing trading desk facilities; (c) authorizing expenditures on behalf of the Fund; (d) supervising preparation of periodic reports to Fund shareholders, notices of distributions and attending to routine shareholder communications; (e) coordinating and supervising the daily pricing and valuation of the Fund’s investment portfolio; (f) providing fund accounting services, including preparing and supervising publication of daily net asset value quotations and other financial data; (g) monitoring and coordinating relationships with unaffiliated service providers; (h) supervising the Fund’s compliance with recordkeeping requirements under the federal securities, state and foreign laws and regulations and maintaining books and records for the Fund; (i) preparing and filing of domestic and foreign tax reports and monitoring the Fund’s compliance with all applicable tax laws and regulations; (j) establishing, maintaining and monitoring the Fund’s compliance program with respect to the federal securities, state and foreign laws and regulations applicable to the operation of investment companies; the Fund’s investment goals, policies and restrictions; and the Code of Ethics and other policies applicable to the Fund; (k) preparing regulatory reports; (l) preparing and arranging for the filing of registration statements and other documents with the SEC and other federal, state and foreign or other regulatory authorities; (m) maintaining a review and certification program and internal controls and procedures in accordance with the Sarbanes Oxley Act of 2002 as applicable; and (n) providing executive, clerical and other personnel needed to carry out the above responsibilities.

Management Fees.Fund? Pursuant to the New IM Agreement, the annual rate of the fee payable to FAV by the Fund under the New IM Agreement would be 0.55% of the Fund’s average daily net assets for investment management and administrative services, whereas the Fund currently pays FT Services 0.10% of the Fund’s average daily net assets for administrative services.

If the New IM AgreementProposal is approved by shareholders, the Fund’s Current Admin Agreement will be terminated.

Fund Expenses. The New IM Agreement includeswould maintain a general listportfolio that complies with non-diversification status. However, the Fund would limit its investments greater than 5% in any one issuer to no more than 50% of expenses that are payable byits assets (rather than the Fund.

Brokerage. In light25% limit imposed upon diversified funds) to continue to comply with the tax diversification requirements of Subchapter M of the new investment management servicesInternal Revenue Code. The 1940 Act diversification requirements are similar to, but, are separate and apart from the diversification requirements that would be provided under the New IM Agreement, FAV will seekFund complies with to obtain the best net price and executionquality for the Fund. The New IM Agreement recognizes that FAV may place orders on behalfspecial tax treatment as set forth in Subchapter M of the FundInternal Revenue Code. The Proposal does not in any way affect the Fund’s ability to comply with a broker who charges a commission for that transactionSubchapter M.

Non-diversified funds are more sensitive to economic, business, political or other changes affecting such or similar issuers or securities, which ismay result in excess of the amount of commissions that another broker would have charged for effecting that transaction, provided that the excess commission is reasonablegreater fluctuation in relation to the value of “brokerage and research services” provided by that broker.

Proxy Voting. In light of the transition to direct investments, the New IM Agreement provides that all decisions on proxy voting with respect to the Fund’s portfolio securities will be made by FAV, unless the Board determines otherwise.

Delegation. The New IM Agreement includes a provision that reflects the ability of the Fund to operate in a “manager of managers” structure, as discussed in Proposal 3, and delegate services to one or more subadvisers.

Limitation of Liability. In the absence of willful misfeasance, bad faith, gross negligence, or reckless disregard of obligations or duties under the New IM Agreement on the part of FAV, FAV shall not be subject to liability to the Trust or the Fund or to any shareholder of the Fund for any act or omission in the course of, or connected with, rendering services thereunder or for any losses that may be sustained in the purchase, holding or sale of any security by the Fund. The same limitation of liability with respect to FT Services’ provision of administrative services is included in the Current Admin Agreement.

Continuance. If shareholders of the Fund approve the New IM Agreement, such agreement shall become effective on the date written and shall continue in effect for[two (2)] years thereafter, unless sooner terminated as provided under the New IM Agreement and shall continue in effect thereafter for periods not exceeding one (1) year so long as such continuation is approved at least annually (i) by a vote of a majority of the outstanding voting securities of the Fund or by a vote of the Board, and (ii) by a vote of a majority of the Trustees of the Trust who are not parties to the New IM Agreement (other than as Trustees of the Trust) or “interested persons” of any such party, cast in person at a meeting called for the purpose of voting on the New IM Agreement.

Termination. Both the New IM Agreement and the Current Admin Agreement may at any time be terminated without the payment of any penalty by the vote of the Board on 60 days’ written notice. The New IM Agreement may also be terminated without payment of any penalty by vote of a majority of the outstanding voting securities of the Fund (as defined by the 1940 Act) on 60 days’ written notice to FAV; shall immediately terminate with respect to the Fund in the event of its assignment; and may be terminated by FAV on 60 days’ written notice to the Fund.shares.

What other investment companies are managed or subadvised by FAV?

Following is a list of funds that are managed by FAV that have investment objectives and strategies similar to the Fund.

Name of Fund

| Net Assets (in millions) as of 9/30/18)

| Investment Management Fee (annually, as a % of average daily net assets)

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

What fees were paid by the Fund to affiliates of FAV during the most recent fiscal year?

Information regarding the fees paid by the Fund to affiliates of FAV during the Fund’s most recently completed fiscal year is provided below under “ADDITIONAL INFORMATION ABOUT THE FUND.”

What did the Board consider when it approved the New IM Agreement?

[To be included in definitive]

What is the required vote on Proposal 1?the Proposal?

The New IM AgreementProposal must be approved by the affirmative vote of a “majority of the outstanding voting securities” of the Fund, aswhich is defined in and required by the 1940 Act. The vote of a “majority of the outstanding voting securities” of the Fund is definedAct as the affirmative vote of the lesser ofof: (A) 67% or more of the voting securities of the Fund present at the Meeting, if the holders of more than 50% of the outstanding voting securities of the Fund are present or represented by proxy; or (B) more than 50% of the outstanding voting securities of the Fund (the “1940 Act Vote”).Fund.

When willIf the Proposal take effect?

If the shareholders of the Fund approve the Proposal, the Portfolio will effect the Repositioning on or about May 1, 2019, to coincide with the annual update of the registration statement for the Fund. If Proposal 1 is not approved by shareholders, of the Fund, it is expected that the FundFund’s classification as a diversified fund and its related fundamental investment restriction will continue to operate under its Current Admin Agreement and the repositioning of the Fund will not takeremain in effect. The Board would then need to consider what steps to take with respect to the ongoing management of the Fund.

THE BOARD UNANIMOUSLY RECOMMENDS THAT

SHAREHOLDERS VOTE “FOR” PROPOSAL 1.the PROPOSAL.

PROPOSAL 2: TO APPROVE NEW SUBADVISORY AGREEMENTS withGlobal Advisors and FT Institutional (THIS PROPOSAL INVOLVES SEPARATE VOTES ON SUB-PROPOSALS 2(A), 2(b) AND 2(C))

The Board, on behalf of the Fund, unanimously recommends, in conjunction with the approval of Proposal 1, that shareholders of the Fund vote to approve one (1) new Subadvisory Agreement between FAV, as investment manager for the Fund, and Global Advisors (the “Global Subadvisory Agreement”), and vote to approve two (2) new Subadvisory Agreements between FAV, as investment manager for the Fund, and FT Institutional (the “FT Subadvisory Agreements”).

Background

As noted above, Management proposed, and the Board approved, the Repositioning. If approved by shareholders, FAV would serve as investment manager of the Fund and manage investment strategy sleeves of the Fund alongside various FT Subadvisers in a “manager of managers” structure. Certain sleeves within the repositioned Fund would be managed by FAV, while others would be managed by FT Subadvisers pursuant to subadvisory agreements between FAV and the respective FT Subadviser. The Fund would pay FAV an overall investment management fee of 0.55% of the Fund’s average daily net assets for its management of the Fund. For a strategy sleeve managed by FAV, the Fund would not pay any additional investment management fees or separate subadvisory fees to FAV. For a strategy sleeve managed by an FT Subadviser, the FT Subadviser would be compensated from the investment management fee paid by the Fund to FAV. Management is proposing that three new subadvisory agreements be approved in connection with the repositioning of the Fund. The names of the strategy sleeves, the proposed FT Subadviser and the proposed subadvisory fee rates are set forth in the table below.

Sub-Proposal

| Strategy Sleeve

| FT Subadviser

| Proposed Subadvisory

Fee Rate

|

2(a)

| Templeton Foreign

| Global Advisors

| 0.25%

|

2(b)

| Franklin International Growth

| FT Institutional

| 0.25%

|

2(c)

| Investment Grade Corporate

| FT Institutional

| 0.40%

|

Why are Global Advisors and FT Institutional recommended to serve as the Fund’s subadvisers?

Global Advisors and FT Institutional are recommended to serve as the Fund’s subadvisers in order to allow them to manage investment strategy sleeves of the Fund alongside FAV in a “manager of managers” structure. Additional information regarding the specific sleeves and their management is provided below:

Sub-Proposal 2(a): Templeton Foreign Strategy (Global Advisors): The strategy seeks long-term capital growth by investing predominantly in foreign securities which are predominantly equity securities of companies located outside of the U.S., including developing markets. The strategy is managed by Tucker Scott, Norman Boersma, Heather Arnold, Christopher James Peel and Herbert J. Arnett Jr.

Sub-Proposal 2(b): Franklin International Growth Strategy (FT Institutional): The strategy seeks capital appreciation by investing predominantly in the equity securities of mid-and large capitalization companies outside the U.S. with long-term growth potential. The strategy is managed by Don Huber and John Remmert.

Sub-Proposal 2(c): Investment Grade Corporate Strategy (FT Institutional): The strategy seeks as high a level of current income as is consistent with prudent investing, while seeking preservation of capital, by investing predominantly in investment grade corporate debt securities and investments. The strategy may invest a significant part of its net assets in foreign securities, including those in developing markets, and a portion of its net assets in non-U.S. dollar denominated securities. The strategy is managed by Marc Kremer and Shawn Lyons.

Management believes it is in the best interests of the Fund’s shareholders for Global Advisors and FT Institutional to manage the sleeves of the Fund discussed above. In order for Global Advisors and FT Institutional to serve as subadvisors for the Fund, shareholders of the Fund are being asked to approve the Global Subadvisory Agreement and FT Subadvisory Agreements. A form of subadvisory agreement is included as Exhibit C to this proxy statement. The only differences between the Global and FT Subadvisory Agreements are the subadvisory fee rates for the different strategy sleeves as noted in the table above.

The addition of Global Advisors and FT Institutional as subadvisers to the Fund will have no impact on the amount of investment management fees that are paid by the Fund or Fund shareholders (other than the increase discussed in Proposal 1) because Global Advisors’ and FT Institutional’s fees will be deducted from the fees that FAV receives from the Fund. If Proposal 1 is not approved by shareholders of the Fund, it is expected that the Fund will continue to operate under its Current Admin Agreement and the repositioning of the Fund, including the Global Subadvisory Agreement and FT Subadvisory Agreements, will not take effect. The Board would then need to consider what steps to take with respect to the ongoing management of the Fund.

Additional Information about FAV

Information regarding FAV, the investment manager proposed for the Fund, is described above in Proposal 1.

Additional Information about Global Advisors

Global Advisors, with its principal offices at Cannon Place, Lyford Cay, Nassau, Bahamas, is organized as a Bahamian corporation, and is registered as an investment adviser with the SEC. On October 23, 2018, the Board voted to approve the Global Subadvisory Agreement and to submit the Global Subadvisory Agreement to the Fund’s shareholders for approval.

Global Advisors is a wholly-owned subsidiary of Templeton Global Holdings Limited, and an indirect wholly-owned subsidiary of Franklin Resources. The following table sets forth the name and principal occupation of the principal executive officer and each director of Global Advisors. Unless otherwise noted, the business address of the principal executive officer and each director in the table below is Lyford Cay, Nassau, Bahamas.

Additional Information about FT Institutional

FT Institutional, with its principal offices at 280 Park Avenue, New York, New York 10017, is organized as a Delaware limited liability company, and is registered as an investment adviser with the SEC. On October 23, 2018, the Board voted to approve each FT Subadvisory Agreement and to submit each FT Subadvisory Agreement to the Fund’s shareholders for approval.

FT Institutional is a wholly-owned subsidiary of Franklin Resources. The following table sets forth the name and principal occupation of the principal executive officer and each director of FT Institutional. Unless otherwise noted, the business address of the principal executive officer and each director in the table below is 280 Park Avenue, New York, New York 10017.

What are the material terms of the Global and FT Subadvisory Agreements?

Below is a summary of the material terms of each Subadvisory Agreement. The following discussion is qualified in its entirety by reference to the form of Subadvisory Agreement attached as Exhibit C to this proxy statement. The only differences between the Global and FT Subadvisory Agreements are the subadvisory fee rates for the different strategy sleeves as noted in the table below.

Services. Subject to the overall policies, direction and review of the Board and subject to the instructions and supervision of FAV, Global Advisors and FT Institutional, pursuant to their respective Subadvisory Agreements, will provide certain investment advisory services with respect to securities and investments and cash equivalents in the Fund.

Subadvisory Fees. Global Advisors’ and FT Institutional’s provision of subadvisory services to the Fund will have no impact on the amount of investment management fees that are paid by the Fund or the fees paid by Fund shareholders(other than the increase discussed in Proposal 1)because the fees that are received by Global Advisors and FT Institutional with respect to each applicable Subadvisory Agreement will be paid directly by FAV.If Proposal 1 is not approved by shareholders of the Fund, it is expected that the Fund will continue to operate under its Current Admin Agreement and the repositioning of the Fund, including the Global Subadvisory Agreement and FT Subadvisory Agreements, will not take effect. The Board would then need to consider what steps to take with respect to the ongoing management of the Fund.

Under each Subadvisory Agreement, FAV would pay Global Advisors or FT Institutional a subadvisory fee based on a percentage of the average daily net assets allocated to the subadviser for the specific strategy sleeve.The names of the strategy sleeves, subadvisers and proposed subadvisory fee rates are set forth in the table below.

Sub-Proposal

| Strategy Sleeve

| FT Subadviser

| Proposed Subadvisory Fee Rate

|

2(a)

| Templeton Foreign

| Global Advisors

| 0.25%

|

2(b)

| Franklin International Growth

| FT Institutional

| 0.25%

|

2(c)

| Investment Grade Corporate

| FT Institutional

| 0.40%

|

Payment of Expenses. During the term of each Subadvisory Agreement, Global Advisors and FT Institutional will each pay all expenses incurred by it in connection with the services to be provided by it under the applicable Subadvisory Agreement, other than the cost of securities (including brokerage commissions, if any) purchased by the Fund.

Brokerage. Global Advisors and FT Institutional will each seek to obtain the most favorable price and execution available when placing trades for the Fund’s portfolio transactions. The Global and FT Subadvisory Agreements each recognize that Global Advisors and FT Institutional may place orders on behalf of the Fund with a broker who charges a commission for that transaction which is in excess of the amount of commissions that another broker would have charged for effecting that transaction, in recognition of the brokerage and research services that such broker provides, in accordance with the Fund’s policies and procedures, the terms of the Fund’s proposed New IM Agreement, the Fund’s prospectus and Statement of Additional Information, and applicable law.

Limitation of Liability. Each Subadvisory Agreement provides that in the absence of willful misfeasance, bad faith, gross negligence, or reckless disregard of its obligations or duties under such agreement on the part of Global Advisors or FT Institutional, neither Global Advisors or FT Institutional nor any of its directors, officers, employees or affiliates will be subject to liability to FAV, the Fund, or to any shareholder of the Fund for any error of judgment or mistake of law or any other act or omission in the course of, or connected with, rendering services thereunder or for any losses that may be sustained in the purchase, holding or sale of any security by the Fund.

Continuance. If shareholders of the Fund approve a Subadvisory Agreement, the Subadvisory Agreement will continue in effect for two years from the date of its execution, unless earlier terminated. The applicable Subadvisory Agreement is thereafter renewable annually for successive periods of twelve (12) months by a vote of a majority of the Trust’s Independent Trustees, cast in person at a meeting called for the purpose of voting on such approval, and either (a) a 1940 Act Majority Vote of the Fund’s shareholders, or (b) a majority of the Board as a whole.

Termination. Each Subadvisory Agreement may be terminated (i) at any time, without payment of any penalty, by the Board upon written notice to FAV and Global Advisors or FT Institutional, as applicable, or by a 1940 Act Majority Vote of the Fund’s shareholders, or (ii) by FAV, Global Advisors or FT Institutional, as applicable, upon not less than sixty (60) days’ written notice to the other party.

What other investment companies are managed or subadvised by Global Advisors and FT Institutional?

Following is a list of funds that are managed or subadvised by Global Advisors and FT Institutionalthat have investment objectives and strategies similar to the strategy sleeve proposed for the Fund.

Sub-Proposal 2(a): Global Advisors (Templeton Foreign)

|

Name of Comparable Fund

| Net Assets of Fund

(in millions) (as of 9/30/18)

| Annual Investment Management/Subadvisory Fee

| Investment Management/

Subadvisory Fee Waived, Reduced or Compensation Otherwise Reduced? (Yes/No)

|

| | | |

| | | |

Sub-Proposal 2(b): FT Institutional (Franklin International Growth)

|

Name of Comparable Fund

| Net Assets of Fund

(in millions) (as of 9/30/18)

| Annual Investment Management/Subadvisory Fee

| Investment Management/

Subadvisory Fee Waived, Reduced or Compensation Otherwise Reduced? (Yes/No)

|

| | | |

| | | |

Sub-Proposal 2(c): FT Institutional (Investment Grade Corporate)

|

Name of Comparable Fund

| Net Assets of Fund

(in millions) (as of 9/30/18)

| Annual Investment Management/Subadvisory Fee

| Investment Management/

Subadvisory Fee Waived, Reduced or Compensation Otherwise Reduced? (Yes/No)

|

| | | |

| | | |

What fees were paid by the Fund to affiliates of FAV, Global Advisors and FT Institutional during the most recent fiscal year?

Information regarding the fees paid by the Fund to affiliates of FAV, Global Advisors and FT Institutional during the Fund’s most recently completed fiscal year is provided below, under “ADDITIONAL INFORMATION ABOUT THE FUND.”

What did the Board consider when it approved the Subadvisory Agreements?

[To be included in definitive]

What is the required vote on Proposal 2?

Proposal 2 consists of three Sub-Proposals. Sub-Proposals 2(a), 2(b) and 2(c) will each be voted on separately by the shareholders of the Fund. Each Sub-Proposal and corresponding Subadvisory Agreement must be approved by the affirmative 1940 Act Majority Vote of shareholders of the Fund. If approved for the Fund, each Subadvisory Agreement is anticipated to become effective on or about May 1, 2019, to coincide with the annual update of the registration statement for the Fund. If Proposal 1 is not approved by shareholders of the Fund, it is expected that the Fund will continue to operate under its Current Admin Agreement and the repositioning of the Fund will not take effect. The Board would then need to consider what steps to take with respect to the ongoing management of the Fund.

If any of Sub-Proposals 2(a), 2(b) or 2(c) are not approved by shareholders of the Fund, the Board will consider what further actions to take, which may include, if Proposal 3 is approved by shareholders, hiring Global Advisors or FT Institutional as a subadviser and providing notice of such hiring to the Fund’s shareholders pursuant to the Order.

THE BOARD UNANIMOUSLY RECOMMENDS THAT